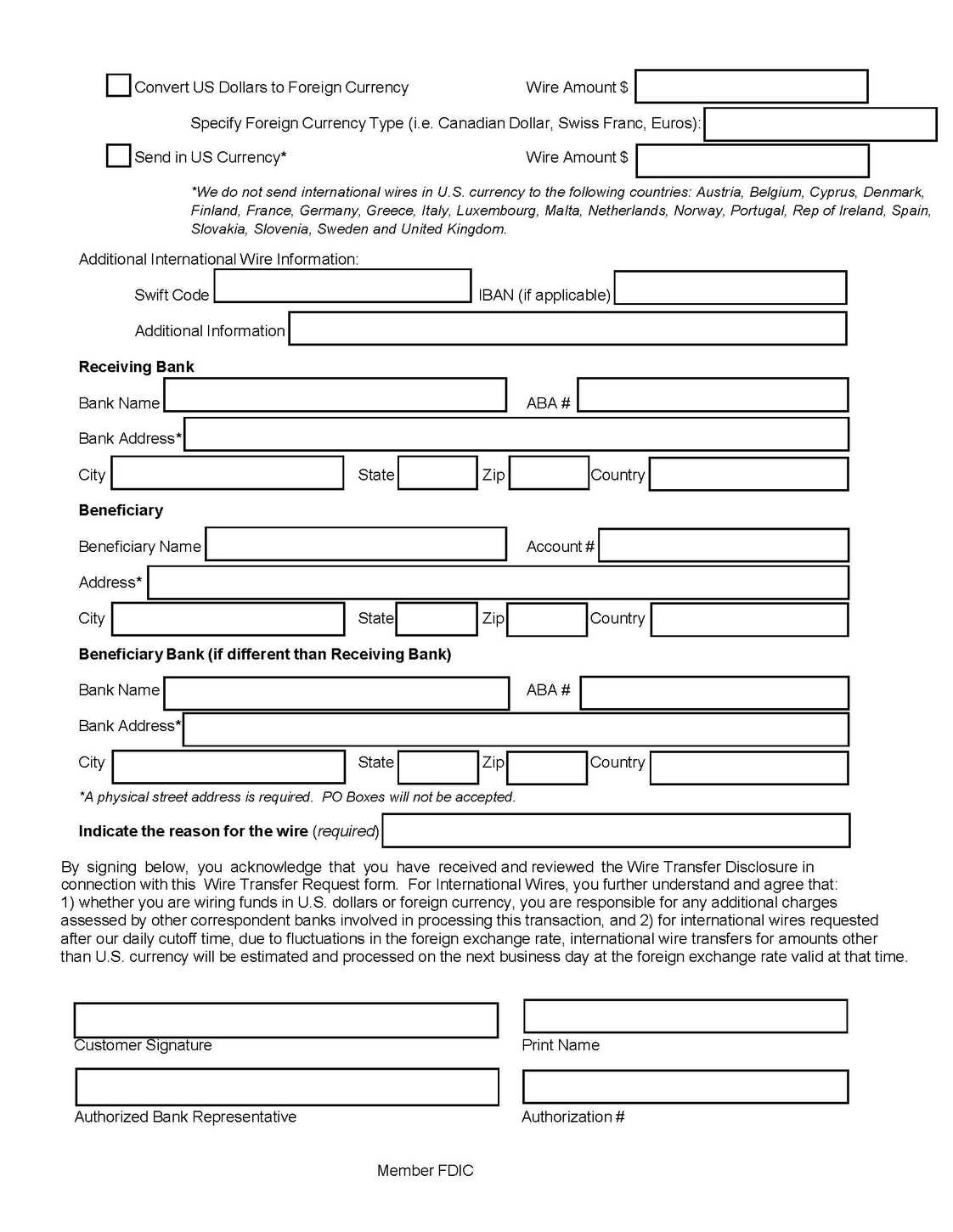

A Chase PR representative explains that dollar limits depend on the type of account and the method being used to send the funds. The agent gave a definitive daily limit for wire transfers, but that answer may or may not have applied to our specific account type. So, how did the agent do during our brief call? Our primary question dealt with dollar limits for wire transfers. But if you’re an account holder, you’re able to find out information that’s specific to your situation. It’s worth noting that unless you already have an account, it’s hard to pin down certain details about wire transfers when you call customer service. In all, we spent between five and 10 minutes on the phone. You also can use the Chase Digital Assistant on the bank’s mobile app.Ī call to Chase’s customer service phone number for personal banking was answered by a polite, friendly agent within a minute or so, once we got past the automated system. This feature isn’t available for international wire transfers from personal accounts.Ī Chase customer can reach customer support by phone, via email (using secure messaging within your online account) or at a bank branch. You can set up a future transfer or recurring transfer as much as 365 days in advance. Future and Recurring Wire TransfersĬhase lets you schedule future and recurring domestic wire transfers from a personal account. However, unlike various money transfer services, Chase doesn’t let money from transferred cash be picked up at a physical location (such as a Western Union office), be delivered to a recipient’s home or be sent from mobile device to mobile device. Bank of America doesn’t offer app-initiated wire transfers. The bank offers these steps for carrying out an international wire transfer through its mobile app:Ĭhase stands out from at least one competitor, Bank of America, in terms of the ability to send a wire transfer via mobile app. The bank offers these steps for carrying out a domestic wire transfer through its mobile app: To initiate an online transfer, you must be enrolled in Chase Online for an app transfer, you must be enrolled in Chase Mobile.

You may be able to do a wire transfer over the phone if you’ve already selected the phone as your backup method for initiating a funds transfer. After Chase has sent the wire, the receiving bank might initiate its own review process.Ĭhase allows a customer to send a wire transfer online, via mobile app or at a branch. If a transfer is requested after the cut-off time, Chase will process it the following business day.īefore Chase sends a wire transfer, the request goes through an internal review process, and in some cases the bank might need to contact the sender to verify your request.

International incoming wire fee chase plus#

Some of these accounts charge transfer fees, ranging from $5 to $50 per transaction.īut holders of higher-tier Chase Premier Plus Checking, Chase Sapphire Checking, Chase Private Client Checking and Chase Private Client Savings accounts can carry out wire transfers without paying fees.Ĭhase’s wire service also may be appealing to someone who sends international transfers, since they can be made in local currency in more than 90 countries if you have a personal account at Chase.Ĭhase processes wire transfer requests from personal accounts the same business day if they’re initiated by 4 p.m. Holders of other types of accounts at Chase can take advantage of wire transfers, though. Wire transfers aren’t available to holders of Chase Secure Checking and Chase First Checking accounts. Otherwise, you might want to seek an alternative. That’s because the bank’s higher-tier accounts don’t charge wire transfer fees.

If you have a higher-tier account, you should consider using Chase’s wire transfer feature. So, if you’re a Chase account holder, should you use the bank’s wire transfer option? Chase wire transfers are available only to the bank’s account holders, which limits who can use the service.

0 kommentar(er)

0 kommentar(er)